Industry leading fraud prevention & financial qualification technology

We use data enrichment, analysis and proprietary fraud technology to truly assess affordability with speed and precision.

Our fraud detection technology puts each applicant through a series of 150+ validation and data enrichment checks. We will uncover any falsification of any document provided to us. We catch fraudulent applications before they become costly.

How we can help your business

Protect your clients from fraud and default

Application fraud is soaring.

We stay one step ahead of the fraudsters to protect you and your reputation.

Approve 25% more applications

We go further than anyone else to understand your applicants' background. As a result we have a 25% higher approval rate with a high degree of confidence.

Create your own bespoke check

Our flexible approach allows us to offer you a tailored solution.

Choose the best environment

for you

Our technology is our strength. We give you the ability to work with us through an integrated solution or our RESTful API.

Fake income documents leave you exposed.

The rate of application fraud is increasing in the UK and with that the market has seen a significant influx in fraudulent documents..

The average cost of a fraudulent tenant in defaults and legal proceedings on average is approximately £40,000, leaving agents and landlords greatly exposed to financial and reputational losses.

Industry leading technology

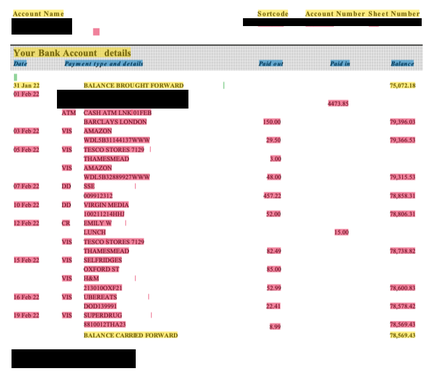

Document analysis

Homeppl's fraud risk assessment technology is unique to the UK market and forensically examines every piece of information contained or hidden in everyday documents, like bank statements, passports, and bills.

Over 52% of the letting agents we surveyed claimed that they have had to deal with false salary information and fake bank statements in the past two years.

Our document analysis tools examine every element of a file from its font to its metadata. Combined with our data enrichment and human intelligence tests, this powerful source of fraud prevention means that we can spot fake financial information every single time.

Data enrichment & behavioural analysis

We securely assess applicants' financial data directly from the widest range of international banks, using open banking, giving you instant accurate results.

Data tells a story. We not only collect financial information but also behavioural information.

Our fraud management solution ensures that every part of that story adds up. We cross-reference an applicant’s financial and residential documents with their employment history and other background information to ensure consistency in the application.

Human intelligence

Once our fraud database has scanned a tenant and detected any potential anomalies, our expert human team of fraud monitors then confirm decisions and clear false declines.

Financial inclusion

The rewarding upside to our thorough fraud prevention technology is that we can approve 25% more applications.

Outdated credit and referencing checks with high rejection rates have lead to approximately five million tenants, including students, expats, internationals, and the self-employed falling through the cracks. This number becomes even more significant when you include a lack of access to other financial products.

Our unique technology is so advanced we can assess the true financial risk of any applicant, making these invisible applicants visible again. We help more people gain financial access on fairer terms.

Bank transaction data

Do you have problems with getting applicants to connect to Open Banking? Homeppl will convert any bank statement into a standardised JSON file and offer instant affordability and transactions data insights. Reap Open Banking benefits from any document, regardless of a connection.